TOLI Simplified

A Roadmap for Trustees and Advisors

A Trustee’s Guide to Evaluating Life Insurance

The major role of a life insurance trustee is the maximization of the value of the life insurance policy held in trust. There are times when the maximization of the trust may cal for the replacement of the existing life insurance policy for one that is more appropriate and provides greater value to the heirs. When that occurs there are many issues to consider. A prudent approach is to consider as many of the issues as possible before making any decision that may affect the eventual out come of the trust.

In the last decade or two, the life insurance industry has undergone a transformation. Lower mortality charges and cost efficiencies have created new life insurance products that may provide a greater value to the life insurance consumer. If you are considering the replacement of a permanent life insurance policy with another, you must first be aware of the possible disadvantages of such a transaction.

You may have to satisfy limits in the new policy that have already been satisfied in the old policy.For example, a life insurance policy has a two-year “incontestable” clause. With the purchase of a new policy, that clause would begin again.

If the present policy has existing loans, the transfer of the policy values may have potential tax consequences. An outstanding loan will be considered part of the policy’s cash value. You should gain an understanding of this issue from a life insurance agent and also discuss this with a tax advisor.

Even if the policy does not have a loan, there could be tax consequences. Generally, if you terminate a life insurance policy, there will be taxes due on the “gain” in the policy, which is defined as the difference between the surrender value (the amount received from the insurance carrier) and the cost basis (the amount of premium paid which includes any carry-over premiums from earlier contracts). These tax consequences can be mitigated with the use of a 1035 Exchange, discussed below.

Policies issued before June 21,1988 may have tax benefits that are not available with the new policy being purchased since they are not subject to the rules governing Modified Endowment Contracts (MEC).If the existing contract is a MEC issued before June 21,1988,you should gain an understanding of this issue from the life insurance agent you are working with and you should also discuss this with a tax advisor.

New life insurance policies contain new sales and acquisition costs and a new surrender charge period. A newly purchased policy may, at any point in time, have values that will be more or less than the values would have been in the policy being replaced.

If you are making the decision to replace an existing policy with a new policy based on a sales illustration that relies on “current assumptions” and non-guaranteed investment returns, please be aware of the following:

Life insurance sales illustrations contain guaranteed and non-guaranteed elements. The non-guaranteed elements are based on interest rate, investment return, and mortality and cost assumptions that may or may not occur.

It should be noted that costs and mortality charges in newer policies have been trending downward as new actuarial tables and market-driven cost efficiencies have come into play

If the new policy to be purchased is a Universal Life or Whole Life product, the investment returns in the policy are based on insurance company-directed accounts that invest primarily in bonds and real estate, including mortgages. There will be an approximate 100-150 basis point difference between the actual returns obtained by the company and the amount credited to the policy. You can request information about the returns obtained and compare them to the amount credited.

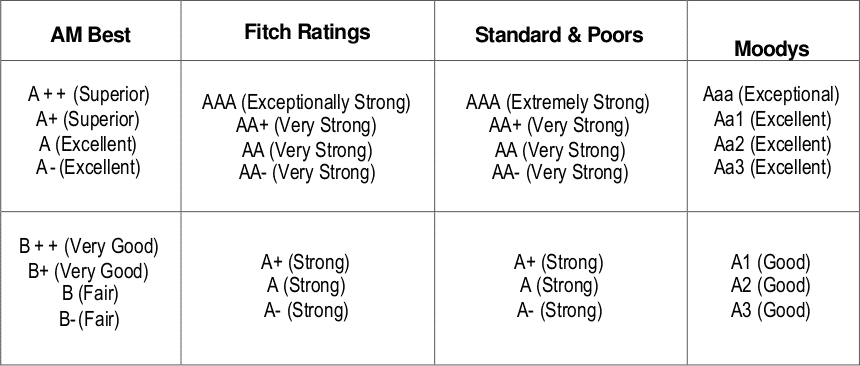

If you are making the decision to replace an existing policy with a new policy based on a sales illustration that relies on “guaranteed assumptions,” understand that the policy guarantees will be only as strong as the carrier backing them. Review the ratings of the selected carrier against this listing of top ratings. Ratings should be monitored for changes.

In addition to the ratings above, it is wise to select a carrier that has a favorable Comdex rating. The Comdex rating is the average percentile ranking for all of the ratings received by a company. As such, it is not another rating, but rather an objective scale that can be used to easily compare the ratings of different companies.

There are a number of very valid reasons why a new policy should be obtained in exchange for another policy

Newer policies may have lower costs. Many of the newer policies available today have cost structures that are lower than policies issued just a few years ago. The carriers tend not to pass these cost savings on to older policyholders – so those who wish to take advantage of the newer costs may need to purchase new, more efficient policies.

Changes in underwriting of the insured(s). Sometimes, the insureds have favorable changes to their health that might affect the cost structure of the policy.

Underwriting opportunities. Specific underwriting programs which “shave” undesirable ratings off the original underwriting offers may become available. These may reduce the mortality costs within the policy.

Carrier financial difficulties. If the financial stability of an insurer changes, it may be prudent to move to a more financially solvent company.

An Internal Revenue Code Section 1035 Exchange refers to a tax-free method of exchanging an existing life insurance policy for a new policy with a different company. A 1035 Exchange allows the contract owner to exchange contracts while preserving the original policy’s tax basis and deferring recognition of gain for federal income tax purposes.

The owner and insured on the“new” contract must be the same as under the “old” contract. However, changes in ownership may occur after the exchange is completed.

Two or more “old” contracts can be exchanged for one “new” contract. No limit is imposed on the number of contracts that can be exchanged for one contract.

The adjusted basis of the“new” contract is the total adjusted basis of all contracts exchanged. The death benefit for the “new” contract may be less than that of the exchanged contract, provided that all other requirements are met.

You cannot exchange a second-to-die policy for a single-life policy or vice versa. However, the IRS has provided guidance in two Private Letter Rulings, which allowed the exchange from a second-to-die policy to a single life policy after the death of one of the insured’s

Under certain circumstances you may exchange a contract with an outstanding loan for a “new” contract. This depends on the guidelines followed by the insurance company with whom the“new” contract is to be taken out.

Advisor Insurance Resource makes no representation regarding the suitability of this concept or the product(s) for an individual nor is Advisor Insurance Resource providing tax or legal advice. You should consult your own tax, legal or other professional advisor before purchasing these products. To ensure compliance with requirements imposed by the IRS,we inform you that, unless expressly stated otherwise, any U.S. federal tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein. Insurance Trust Monitor (ITM) is an out sourcer for TOLI Simplified that provides total administration services for life insurance trusts. ITM is not an Advisor Insurance Resource company