Long-Term Care Cost of Waiting – Starting Age 45

Summary

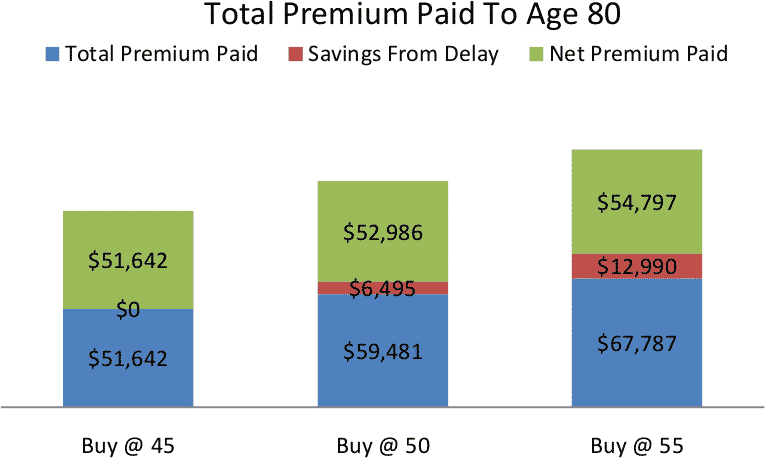

– Waiting to age 50 will cost $1,344 more in premium through age 80, or about 2.6%.

– Waiting to age 55 will cost $3,155 more in premium through age 80, or about 6.1%.

– Waiting increases your chance of not receiving a preferred health discount by 42%.

– Waiting increases your chance of having an application for longterm care insurance declined by 47%.

– You have a 160% greater chance of needing long-term care services before you purchase long-term care insurance if you wait 10 years to buy a policy.

– Future premiums may be higher if insurers raise their new business premiums before you buy a policy.

– Relative costs for a single person are the same as for a married person.

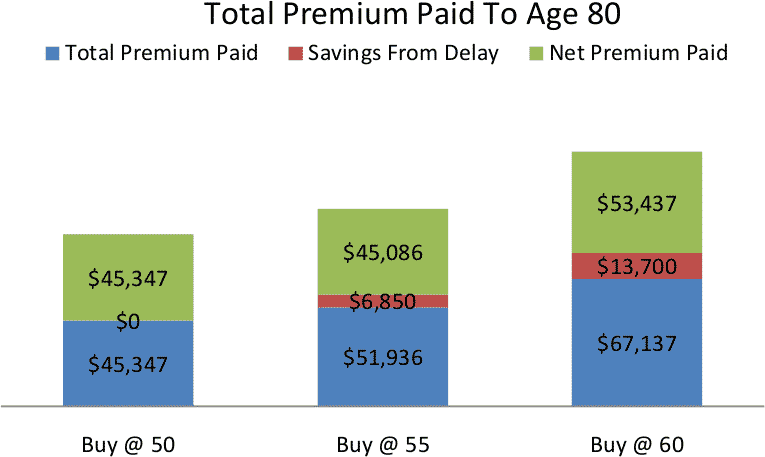

Long-Term Care Cost of Waiting – Starting Age 50

Summary

– Waiting to age 55 will cost $459 less in premium through age 80, or about 1%.

– Waiting to age 60 will cost $8,090 more in premium through age 80, or about 17.8%.

– Waiting increases your chance of not receiving a preferred health discount by 14.8%.

– Waiting increases your chance of having an application for longterm care insurance declined by 64%.

– You have a 477% greater chance of needing long-term care services before you purchase long-term care insurance if you wait 10 years to buy a policy.

– Future premiums may be higher if insurers raise their new business premiums before you buy a policy.

– Relative costs for a single person are the same as for a married person.

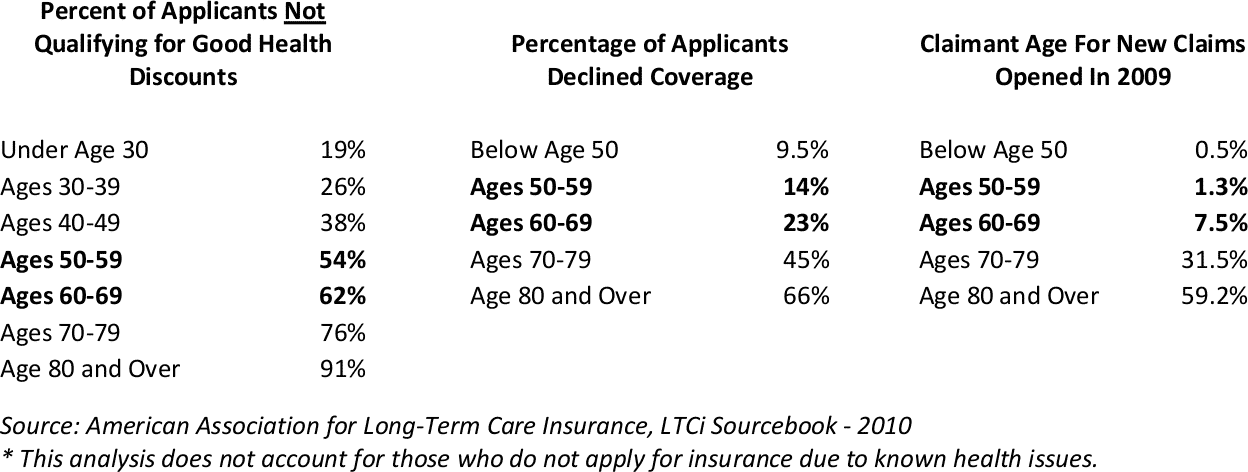

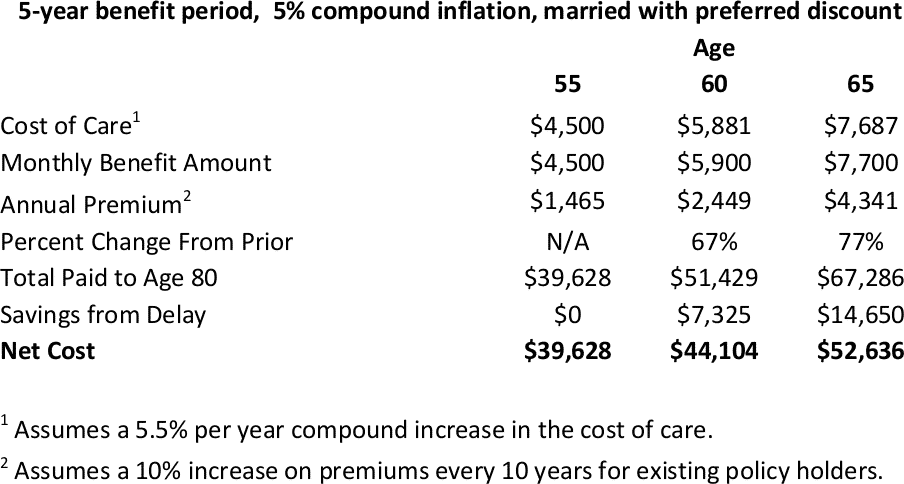

Long-Term Care Cost of Waiting – Starting Age 55

Summary

– Waiting to age 60 will cost $4,476 more in premium through age 80, or about 11%.

– Waiting to age 65 will cost $13,008 more in premium through age 80, or about 33%.

– Waiting increases your chance of not receiving a preferred health discount by 14.8%.

– Waiting increases your chance of having an application for longterm care insurance declined by 64%.

– You have a 477% greater chance of needing long-term care services before you purchase long-term care insurance if you wait 10 years to buy a policy.

– Future premiums may be higher if insurers raise their new business premiums before you buy a policy.

– Relative costs for a single person are the same as for a married person.

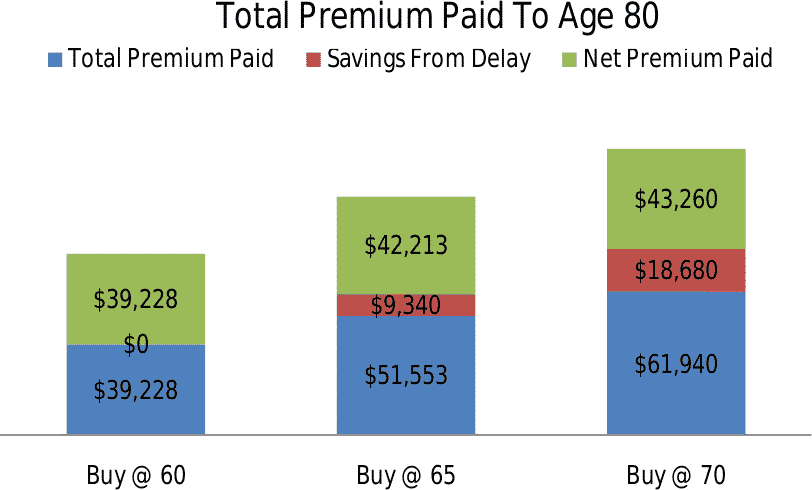

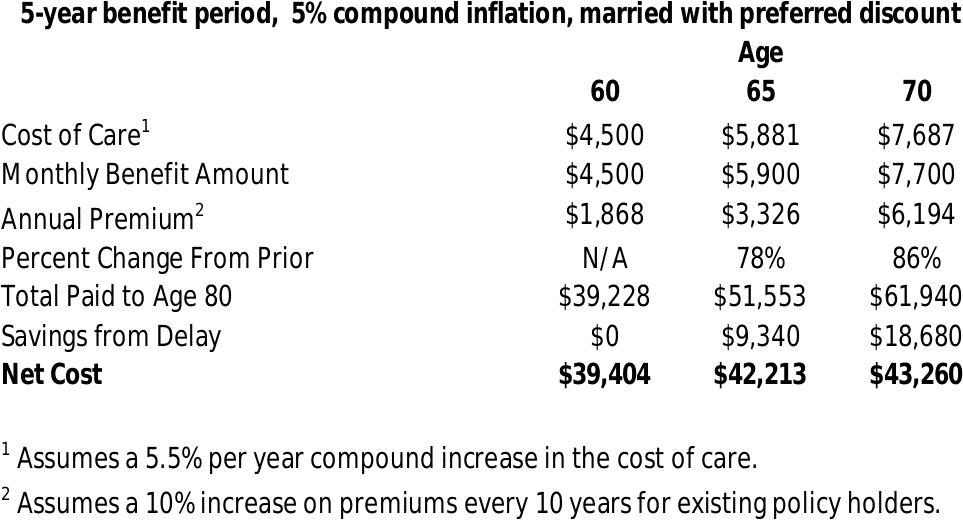

Long-Term Care Cost of Waiting – Starting Age 60

Summary

– Waiting to age 65 will cost $2,985 more in premium through age 80, or about 7.6%.

– Waiting to age 70 will cost $4,032 more in premium through age 80, or about 10.3%.

– Waiting increases your chance of not receiving a preferred health discount by 22.5%.

– Waiting increases your chance of having an application for longterm care insurance declined by 95.6%.

– You have a 320% greater chance of needing long-term care services before you purchase long-term care insurance if you wait 10 years to buy a policy.

– Future premiums may be higher if insurers raise their new business premiums before you buy a policy.

– Relative costs for a single person are the same as for a married person.

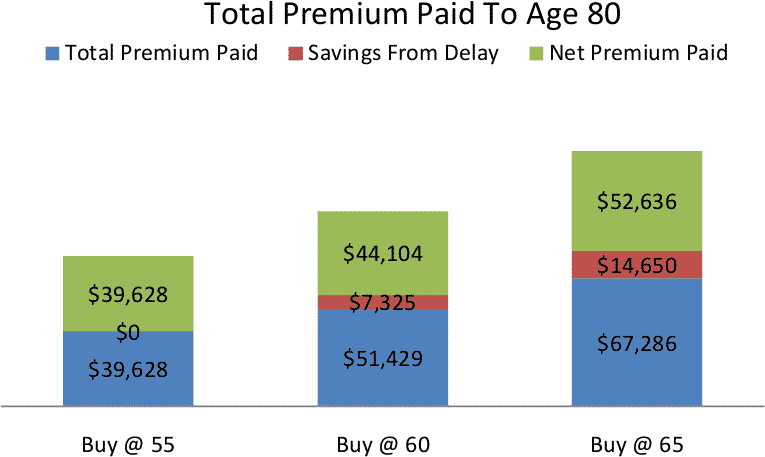

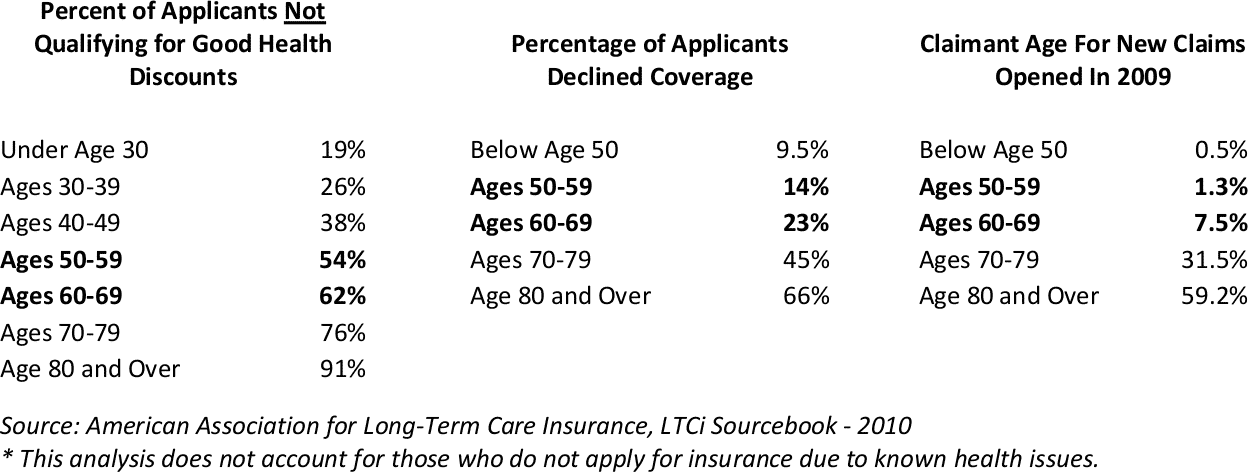

One of the most commonly asked questions regarding long-term care insurance is “What is the best age to purchase long-term care insurance?” Although there is no single correct answer, there are several factors to consider when deciding the proper time to purchase long-term care insurance. These factors include increases in care costs, increases in premium for later ages, preferred health discount probability, the possibility of being declined coverage and the risk of requiring long-term care services without having coverage.

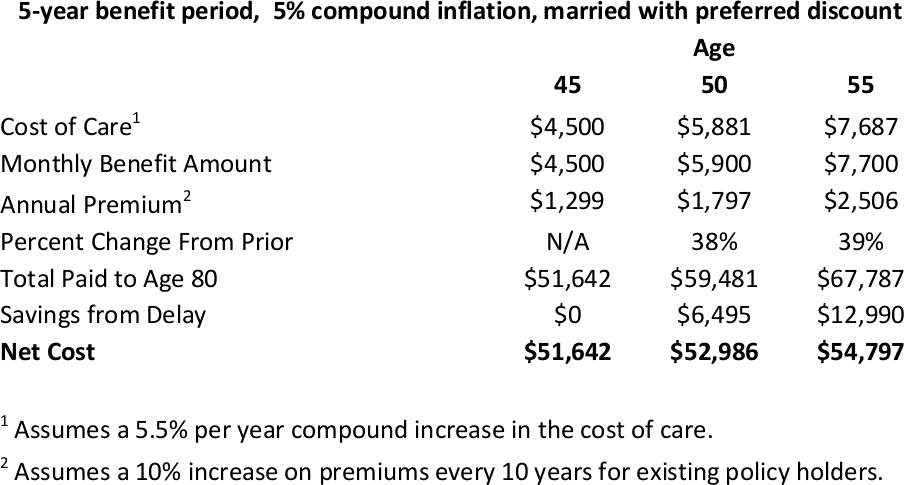

Genworth, a leading long-term care insurer produces an annual report on the cost of long-term care services. The company’s 2010 Cost of Care Study reports a five year average increase for a private room in an assisted living facility of 6.7% and 4.5% for nursing care. The rising trend for cost of care is expected to continue and it is my opinion that these costs will likely increase at a greater rate than in the past. Therefore, one factor for consideration in delaying the purchase of long-term care insurance is the amount of coverage you will need to purchase in the future to keep pace with the rising costs of care. This analysis assumes you must purchase an additional 5.5% coverage amount average increase per year on a compound basis.

Long-term care insurance premiums are based primarily on age. For most companies, new business premiums increase each year after the age of 40. This analysis demonstrates the premiums for a specified coverage amount at given ages based on Genworth’s premiums as of January 2011. Premiums are based on being married and include the preferred health discount. The analysis holds true for single consumers.

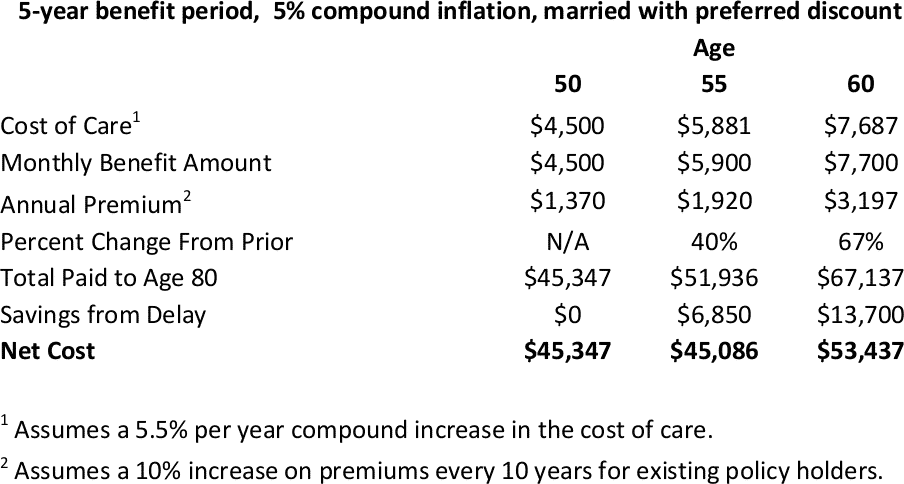

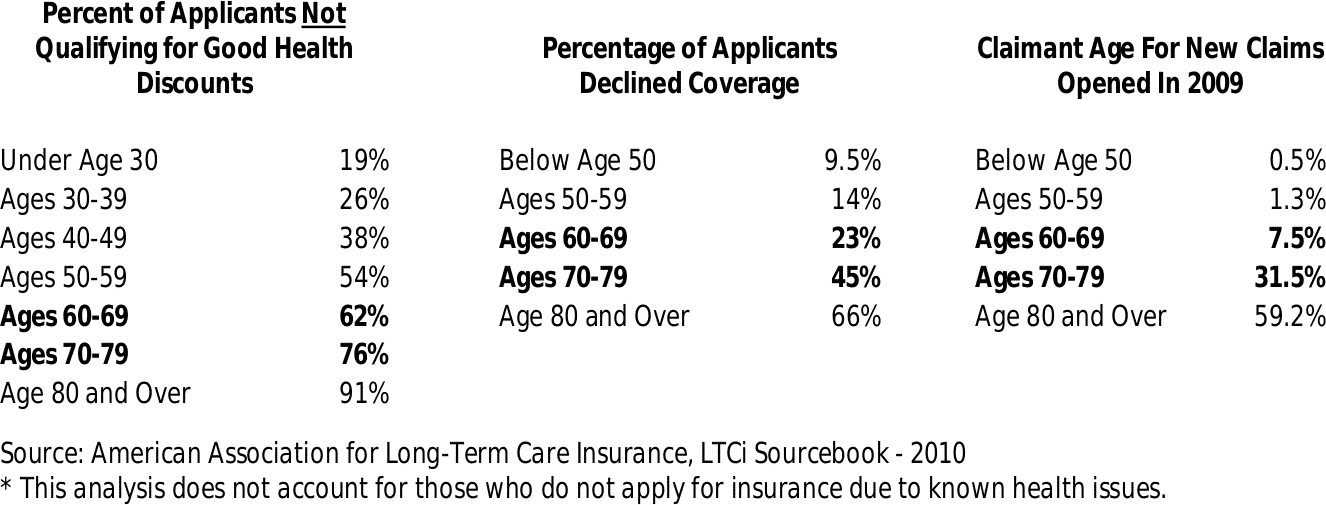

The 2010 American Association of Long-Term Care Insurance, LTCi Sourcebook reports 81% of people under the age of 30 who apply for long-term care insurance receive the preferred health discount. This drops to 74% for those between 30-39, 62% for those 40-49, 46% for those 50-59, 38% for those 60-69 and 24% for those 70-79. For most companies the preferred health discount reduces the premium paid by 10-20%.

The 2010 American Association of Long-Term Care Insurance, LTCi Sourcebook also reports that only 9.5% of people who apply for coverage under the age of 50 are declined coverage. This increases to 14% for those 50- 59, 23% for those 60-69, 45% for those 40-49 and 66% for those over 80. Being declined for coverage is one of the greatest financial risks consumers face. This should be a substantial consideration given that nearly 1 in 4 people who apply for coverage in their 60’s are declined. This does not account for those who do not apply for coverage due to known health issues.

The final consideration is the amount of people who require care at a given age. The 2010 American Association of Long-Term Care Insurance, LTCi Sourcebook reports 1.3% of claims opened in 2009 were for those between the ages of 50-59, 7.5% for those 60-69, 31.5% for those 70-79 and 59.2% for those over 80.

So what does this all mean? Simply put, there are several factors when considering the best time to purchase long-term care insurance. The following analysis takes into account the above points to provide an understanding of the net present value of total premiums paid when purchasing coverage at a specific age and delaying the purchase for any number of years.

The analysis assumes a 10% increase on premiums every 10-years once the policy is purchased to account for premium increases. Consumers should also understand that future premiums for new policy holders will increase overtime as insurers introduce new products. We see insurance companies increase premiums about 8%- 10% every 5-8 years with new products. This analysis does not account for this change. Doing so would increase the cost of waiting.