Several long-term care insurers recently began offering inflation adjustments tied to CPI in addition to the traditional 5% compound and 5% simple methods. Many insurers’ marketing materials suggest that CPI adjustments are more logical than a random 5% number chosen many years ago. However, recent price increases on new long-term care insurance policies indicates the offering is designed to lessen the impact of constantly raising new business premiums.

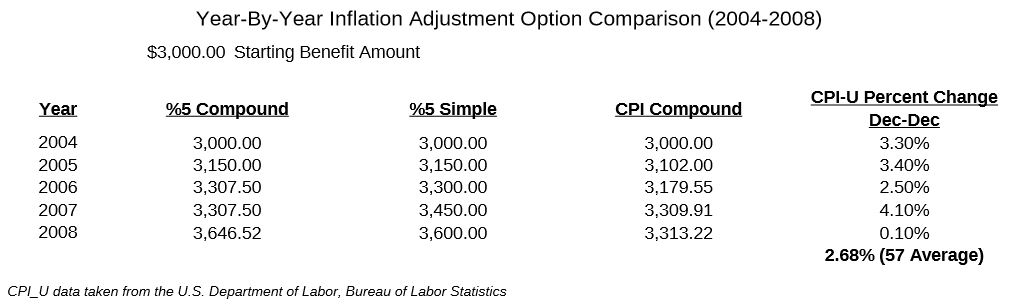

I performed an analysis to determine the true impact of CPI based inflation protection on long-term care insurance policies. The first step in this analysis was to determine the year-by-year adjustment in benefit amount for each of the three inflation options evaluated. (See Table Below).

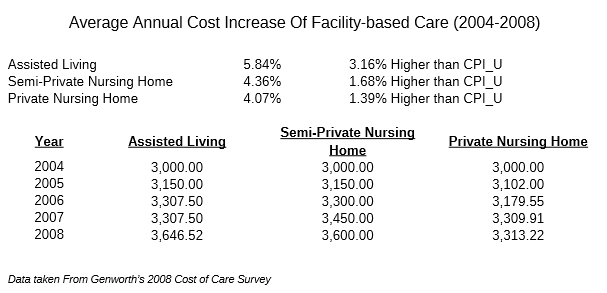

The 5% compound method increased the benefit amount by over 50% more than the CPI linked method. The brief time period used reflects the most up to date information regarding the increase in long-term care costs. Although some insurers have insisted that the CPI based inflation protection more closely follows the actual cost increases of long-term care services, the actual data disagrees. (See Table Below).

The cost for assisted living, semi-private nursing home, and private nursing home care rose at a higher rate than the CPI-U for the most recent five year period. In fact, the five year average cost in assisted living care increased over 100% more than the CPI-U for the same time period. It is my opinion that costs will accelerate even faster as more of the baby boomer generation requires long-term care services in the future. Thus, this widening spread increases the amount of coinsurance an individual assumes on his or her long-term care policy.

The premium saved when using the CPI linked inflation adjustment is minimal when evaluating a claim scenario. A benefit spread of $300.00 per month over a five year period as illustrated above will likely consume the cost savings of the policy. Generally, the CPI linked inflation option is 15% lower in cost than the 5% compound option. That equates to $450.00 per year on a $3,000.00 annual premium, or $2,250.00 over a five year period. The break-even point if a claim is filed is only 7.5 months ($450.00 x 5 / $300.00). The client is much better off with the 5% compound option since most claims last much longer than 7.5 months. For this reason, I recommend 5% compound inflation over CPI linked inflation in most long-term care cases. CPI linked inflation protection may be a reasonable option for older consumers.