Need for Protection

A disability can happen to anyone…at any time.

Just over 1 in 4 of today’s 20 year olds will become disabled before they retire.– U.S. Social Security Administration, Fact Sheet February 7, 2013

8.8 million disabled wage earners were receiving Social Security Disability benefits at the end of 2012 (over 5% of US workers).– U.S. Social Security Administration, Disabled Worker Beneficiary Data, December 2012

In December of 2012, there were over 2.5 million disabled workers in their 20s, 30s and 40s receiving Social Security Disability benefits.– U.S. Social Security Administration, Disabled Worker Beneficiary Data, December 2012

56.7 million Americans have some level of disability. They represent 19% of the population. More than half have a severe disability.– U.S. Census Bureau, July, 2012

64% of wage earners believe they have a 2% or less chance of being disabled for 3 months or more.– Council for Disability Awareness, Disability Divide Consumer Disability Awareness Study, 2010

The actual odds for a worker entering the workforce today of becoming disabled for 3 months or more during their working careers is about 25%.– U.S. Social Security Administration, Fact Sheet February 7, 2013

In 2010, the employment rate of working-age people with disabilities in the U.S. was 41%.– U.S. Census Bureau, July, 2012

At age 40, the average worker faces only a 14% chance of dying before age 65 but a 21% chance of being disabled for 90 days or more.– Insurance Information Institute, www.iii.org November, 2005

In 2007, 12.8% of people ages 21-64 surveyed have a disabling illness.– U.S. Census Bureau, American Community Survey, 2007

You have a 1 in 21 chance that you’ll have a disabling accident.– 2005 Field Guide to Estate Planning, Business Planning & Employee Benefits, by Donald Cady

In the U.S., a disabling injury occurs every 1 second, a fatal injury occurs every 4 minutes.– National Safety Council® , Injury Facts® 2008 Ed.

In the last 10 minutes, 498 Americans became disabled.– National Safety Council® , Injury Facts® 2008 Ed.

In the home a fatal injury occurs every 12 minutes and a disabling injury every 3 seconds.– National Safety Council® , Injury Facts® 2008 Ed.

There is a death caused by a motor vehicle crash every 12 minutes; there is a disabling injury every 13 seconds.– National Safety Council® , Injury Facts® 2008 Ed.

Almost 3 in 10 workers entering the workforce today will become disabled before retirement.– Social Security Administration, Fact Sheet, January 31, 2007

43% of all people age 40 will have a long-term disability event prior to age 65.– JHA Disability Fact Book, 2006

Retirement Protection and American Savings Patterns

Most Americans can’t afford to become disabled.

Over 50% of people do not have private pension coverage and 1/3 have no retirement savings. – U.S. Social Security Administration, Fact Sheet February 7, 2013

68% of Americans would find it very difficult or somewhat difficult to meet their current financial obligations if their next paycheck were delayed for one week. – American Payroll Association, “Getting Paid in America” Survey, 2012

65% of working Americans say they could not cover normal living expenses even for a year if their employment income was lost and 38% could not pay their bills for more than 3 months. – Council for Disability Awareness, Disability Divide Consumer Disability Awareness Study, 2010

48% of U.S. families don’t save any of their annual income. – U.S. Federal Reserve Board, Survey of Consumer Finances, 2010

According to the Federal Reserve, 44% of U.S. families spend more than they earn. – Federal Reserve Board, Survey of Consumer Finances, 2004

In 2007, the median income of households that include any working-age people with disabilities in the U.S. was $38,400. – U.S. Census Bureau, American Community Survey, 2007

Over 70% of working Americans do not have enough savings to meet short-term emergencies. – National Investment Watch Survey, A.G. Edwards Inc., 2004

Over 50% of the workforce has no private pension coverage and a third have no retirement savings. – Social Security Administration, Fact Sheet 2007

71% of American employees live from paycheck to paycheck. – American Payroll Association, “Getting Paid in America” Survey, 2008

Only 40% of adult Americans have separate emergency savings funds. – National survey commissioned by the Consumer Federation of America (CFA) and carried out by Opinion Research Corporation, February 2007

More than 35% of workers with 401(k) or IRA plans have not thought about or don’t know what would happen to their contributions if they were unable to earn an income for a period of time. – Council for Disability Awareness, 2007 Disability Survey

The average American savings rate in October 2008 was 2.4% of disposable personal income, compared to 1985 when the savings rate was 10.3%. – A Guide to the National Income and Product Accounts of the United States (NIPA) – http://www.bea.gov/bea/an/nipaguid.pdf

Causes of Disability

Illnesses generally cause disabilities, not accidents.

Over 85% of disabling accidents and illnesses are not work related. – National Safety Council® , Injury Facts® 2008 Ed.

While many people think that disabilities are typically caused by freak accidents, the majority of long-term absences are actually due to illnesses, such as cancer and heart disease. – Life and Health Insurance Foundation for Education November, 2005

Stroke is a leading cause of serious long–term disability. – American Heart Associates, Heart Disease and Stroke Statistics – 2015 Update

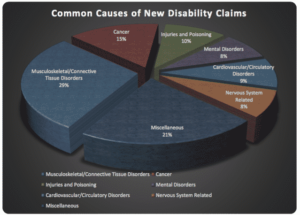

Common causes of individual disability insurance claims are:

Miscellaneous categories include: Respiratory System 2.3%, Infections/Parasitic Diseases 1.9%, Ill-Defined Symptoms 2.8%, Digestive System 2.6%, Genitourinary System 2.1%, Endocrine, 1.3%, Complications of Pregnancy/Childbirth 5.9%, Skin/Subcutaneous .8%, Congenital Anomalies .5%, Blood Forming Organs .2%, and Other .9%

– Counsel for Disability Awareness, Long-Term Disability Claims Review, 2013

Disability Duration

An average disability may last longer than you think.

The average individual disability claim lasts 31.6 months. – Gen Re, U.S. Individual DI Risk Management Survey 2011, based on claims closed in 2010

The average group long-term disability claim lasts 34.6 months. – Gen Re, U.S. Group Disability Rate & risk Management Survey 2012, based on claims closed in 2011

1 in 8 workers will be disabled for 5 years or more during their working careers. – Commissioner’s Disability Insurance Tables A and Cs

Nearly 1 in 5 Americans will become disabled for 1 year or more before the age of 65. – Life and Health Insurance Foundation for Education. November 2005

Three out of 10 workers between the ages of 25 and 65 will experience an accident or illness that keeps them out of work for 3 months or longer. – Social Security Administration, Fact Sheet, January 31, 2007

Nearly 1 in 3 Americans ages 35-65 will become disabled for more than 90 days – 2005 Field Guide to Estate Planning, Business Planning & Employee Benefits, by Donald Cady

Disability Costs

Indirect and direct costs of a disability take financial tolls on everyone.

Off-the-job injuries to workers cost the nation at least $262.2 billion and 235 million days of production time in 2011. – National Safety Council®, Injury Facts® 2013 Ed.

The average disability absence results in payments of $3,800, while lost productivity costs on average over $22,800. – Integrated Benefits Institute, IBI News September 8th, 2006

The “total costs” associated with each disability absence exceeds $35,000. – Integrated Benefits Institute, IBI News September 8th, 2007

Employers spend 4.1% of payroll on unscheduled absences. – Marsh/Mercer Health & Benefits, “Health, Productivity and Absence Management Programs”, 2006 Survey report

In 2006, unscheduled absence cost some large employers an estimated $850,000 per year in direct payroll. – CCH and Harris Interactive, “2006 CCH Unscheduled Absence Survey,” October 2006

Disabling injuries and illnesses account for 55% of employee absences. – JHA 2005 Absence Management Survey, “Big-picture benefits: Integrating FMLA and disability claims data helps reduce absenteeism,” by Chris Silva, September 2006

Just 10% of disability cases account for more than half the total medical and disability costs. – Integrated Benefits Institute, IBI News September 8th, 2008

Misconceptions

Common back-up plans to loss of income may not be an option.

More than 1 in 5 adults believe that unemployment or Social Security will cover them if they become disabled. – Disability Literacy: How Consumers Rate Today, April 2005, The Hartford

65% of initial SSDI claim applications were denied in 2012. – U.S. Social Security Administration, Disabled Worker Beneficiary Data, December 2012

In 2012, the average monthly benefit paid by SSDI was $1,130.00 per month – U.S. Social Security Administration, Disabled Worker Beneficiary Data, December 2012

By the end of 2012:

7.3% of SSDI recipients received less than $500 per month

46% received less than $1,000 per month

93% received less than $2,000 per month

– U.S. Social Security Administration, Disabled Worker Beneficiary Data, December 2012

There were over 2.8 million new Social Security Disability Insurance (SSDI) applications in 2012. This is 29% higher than in 2007. – U.S. Social Security Administration, Disabled Worker Beneficiary Data, December 2012

Most working Americans estimate that their own chances of experiencing a long term disability are substantially lower than the average worker’s. – Council for Disability Awareness, Disability Divide Consumer Disability Awareness Study, 2010

61% of surveyed wage earners personally know someone who has been disabled and unable to work for 3 months or longer. – Council for Disability Awareness, Disability Divide Consumer Disability Awareness Study, 2010

In 2007, the percentage of working-age people with disabilities receiving SSDI payments in the US was 17.1%. – U.S. Census Bureau, American Community Survey, 2007

Over 85% of disabling accidents and illnesses are not work related, and therefore not covered by workers’ compensation. – National Safety Council® , Injury Facts® 2008 Ed.

Over 6.8 million workers are receiving SSDI benefits, almost half are under age 50. This represents only 13% of the over 51 million Americans classified as disabled. – Social Security Administration, Fact Sheet 2007

Market Data

There is a need for disability insurance.

Fewer than one in three (29%) U.S. workers have private long-term disability coverage – National Compensation Survey, Bureau of Labor Statistics, 2006

70% of the private sector workforce has no long-term disability insurance. – Social Security Administration, Fact Sheet 2007

Only 30% of American workers in private industry currently have access to employer-sponsored long-term disability insurance coverage. – National Compensation Survey: Employee Benefits in Private Industry in the United States, U.S. Department of Labor, Bureau of Labor Statistics, March 2006.

Only 5% of baby boomers realize they have a 34% chance of becoming disabled during their working years. – Harris Interactive/AHIP, Baby Boomers’ Awareness of Disability Risks, February 2008

Nearly 9 in 10 workers (86%) surveyed believe that people should plan in their 20s or 30s in case an income limiting disability should occur

Only 50% of all workers have actually planned for this possibility.

Only 46% have even discussed disability planning.

– Council for Disability Awareness, Worker Disability Planning and Preparedness Study, 2009.

About 43% of wealthy business owners (almost double the percentage of other affluent Americans questioned) said they would work to age 70 or later, but only one-third of these owners said they have written succession plans in place. – Private Wealth magazine, April-May 2008; survey by PNC Wealth Management, Philadelphia, PA

The odds of selling a product to a new customer are 15 percent, while the odds of selling to an existing customer are 50 percent. – Raymond Adamson, Cross-Sell to Success, Advisor Today, March 2005