Term life insurance is a relatively simple insurance product. Policy provisions such as renewability, convertibility and face amount flexibility are usually considered when purchasing a policy. The insurance industry recognizes that many consumers choose not to purchase term life insurance because they feel it is a waste of money if they don’t use the coverage. In response, insurance companies created return of premium (ROP) term life policies, which insurance agents are now marketing. These policies vary slightly from company to company, but all provide a return of some or all premiums paid in the event the insured does not pass away before the end of the term.

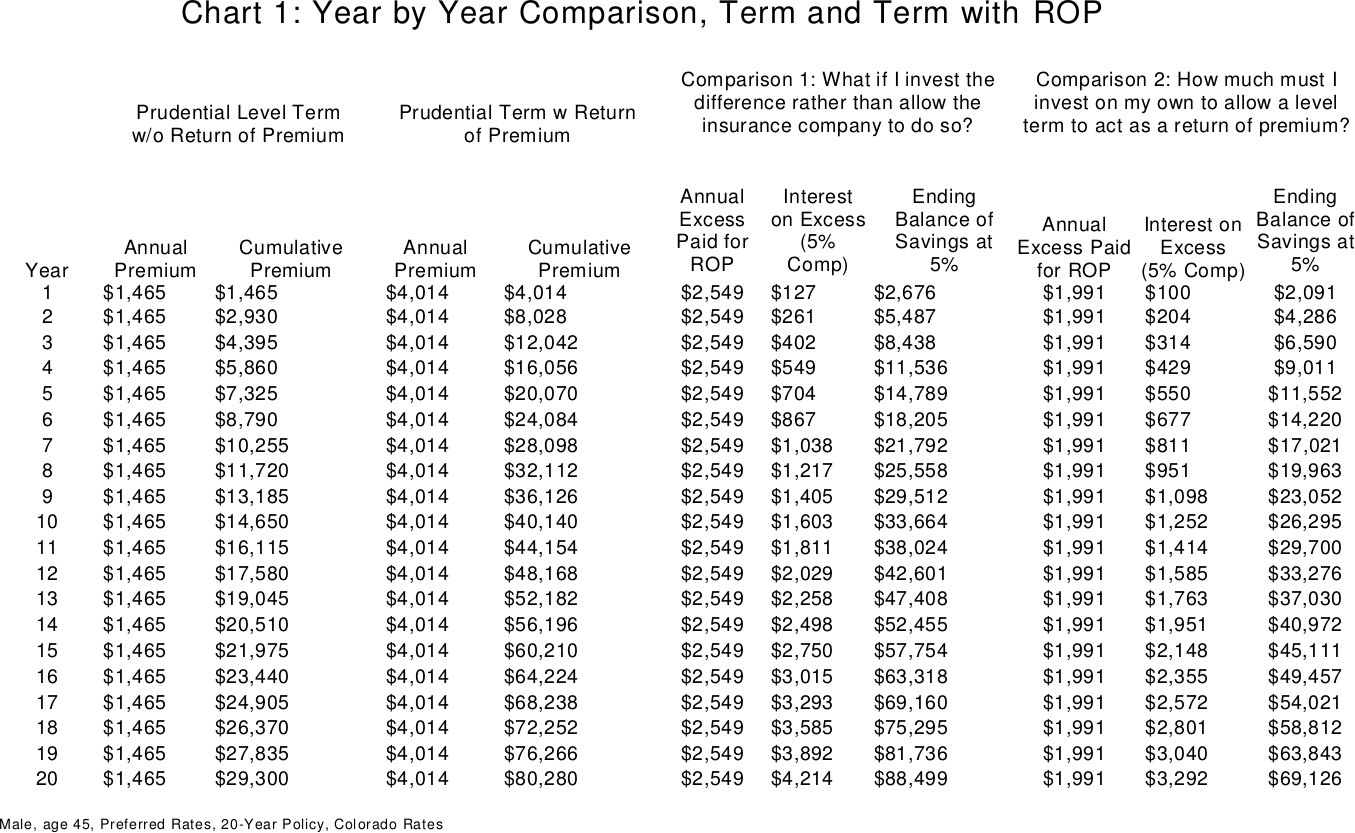

After evaluating several companies, I have chosen to focus on Prudential Life Insurance Company for this analysis. Prudential offers both level term policies and level premium policies with a ROP provision. The chart below illustrates the premiums for both level term and level term with ROP, along with the details of my comparisons for a $500,000.00 policy. The premium for the level term policy without ROP was $1,465.00 per year. The premium for the policy with ROP was $4,114.00 per year. This is $2,649.00 per year more than the policy without ROP.

The above comparison shows the cumulative premium paid for the term policy without ROP is $29,300.00 at the end of the 20th year. The premium paid for the ROP policy is $80,280.00 at the end of the 20th year. This is a difference of $50,980.00 over 20 years. The full $80,280.00 is returned to the insured on the ROP policy at the end of 20 years if no claim has been paid.

However, if the insured purchased the regular term policy for $1,465.00 per year and invested the difference of $2,549.00 per year at 5% compound interest, he or she would have $88,499.00, a difference of $8,219.00 in the insured’s favor. Additionally, in the event the insured passed away while the policy was in force, the second option would have paid the death benefit and the insured would have the additional cash in savings. For example, if the insured passed away in the 12 th year, the policy would pay a death benefit of $500,000.00 and the insured would have $42,601.00 in savings for a total of $542,601.00. A ROP policy would have only paid the $500,000.00 death benefit. This exercise concludes that more often than not an insured that buys regular term insurance and invests the difference will generally perform better than a ROP policy.

I also reviewed how much an insured would have to invest to make a regular term policy act as a ROP policy. I found that the insured would have to invest about 20% less than required under the ROP policy. In this specific example, the insured would purchase a term insurance policy for $1,465.00 per year and invest $1,991.00 per year. At 5% compound on the investment, the account would grow to $69,126.00 at the end of the 20th year. The total premiums paid for the life policy plus the savings contributions would equal $69,120.00. This demonstrates that more often than not an insured that buys regular term insurance has the ability to invest less than would be required under a ROP policy to earn enough growth to account for all premiums paid.

The ROP idea offers “free insurance” for consumers who are concerned about “wasting” premiums paid if they don’t use the coverage. Individuals who seek the guidance of qualified financial professionals generally have a greater ability to reduce insurance costs, increase death benefits and out-perform ROP policies. For these reasons, I conclude that return of premium policies are generally not in the client’s best interest. The exception to this is when a 5% compound rate of return is unrealistic given the insured’s investment tolerance. Considering this exception, the guarantees offered by the ROP policy may become attractive.